SUBIC BAY FREEPORT — This appears to be an unintended effect of the CREATE MORE Law.

Contiguous communities affected by the operations of the Subic Bay Special Economic and Freeport Zone recently received from the Subic Bay Metropolitan Authority (SBMA) a total of P143 million as revenue shares from the 5% tax on gross income paid by registered business locators here.

The total amount represented the shares for eight neighboring local government units (LGUs) from corporate taxes collected in Subic in the second half of 2024.

However, the latest release of shares showed a marked decrease of 20 percent, compared to previous releases of P178 million in the last two years.

The notable decrease in LGU shares, said SBMA OIC deputy administrator for corporate communications Armie Llamas, is seen as an effect of recent government measures on reforming the corporate income tax and incentives system.

The agency released last February P33.48 million to Olongapo City, which traditionally gets the biggest share due to its large population; P21.48 million to Subic, Zambales; P21.48 million to Dinalupihan, Bataan; and P17.19 million to San Marcelino, Zambales.

The other LGUs received their shares as follows: Hermosa, Bataan, P15.33 million; Castillejos, Zambales, P13.02 million; Morong, Bataan, P12.66 million; and San Antonio, Zambales, P12.17 million.

Looking back, however, the LGUs got heftier shares totaling P178 million in February last year: P41.62 million for Olongapo; P26.7 million for Subic; P22.17 million for Dinalupihan; P21.37 million for San Marcelino; P19.06 million for Hermosa; P16.18 million for Castillejos; P15.73 million for Morong; and P15.3 million for San Antonio.

The LGUs even received slightly higher shares from a total of P178.7 million released in February 2023 for revenues collected in the second half of 2022.

According to Llamas, SBMA Chairman Eduardo Jose Aliño had explained that “due to the 20 percent corporate recovery tax, which took effect last November 28, 2024, shares for the second half of the same year dipped significantly with a difference of P61.6 million.” This, she said further quoting Aliño, was for businesses under the Economic Development Regime (EDR) on income derived from registered projects or activities.

Corporate income tax for resident foreign corporations like those in Subic was first reduced from 30% to 25% under Republic Act No. 11534, or the “Corporate Recovery and Tax Incentives for Enterprises Act” (CREATE Law), which sought to improve the equity and efficiency of the corporate tax system by lowering the rate, widening the tax base, and reducing tax distortions and leakages.

The tax rate further sank to 20% under R.A. 12066, or the “Corporate Recovery and Tax Incentives for Enterprises to Maximize Opportunities for Reinvigorating the Economy” (CREATE MORE) Act.

While LGU shares traditionally increased over the years due to the influx of new investments in the Subic Freeport, the lower tax rate for investors is seen to create a significant pull on this upward trend.

In the last five years, the LGU shares released by the SBMA in the second half steadily increased from P166.16 million in August 2021 to P180.67 million in July 2022; P203 million in August 2023; and P204.5 million in September 2024.

On the other hand, LGU shares released in the first semesters fluctuated from P123.1 million in January 2021 to P140 million in January 2022; P178.7 million in February 2023; P178 million in February 2024; and P143.03 million in 2025. (Taktikom News and Features)

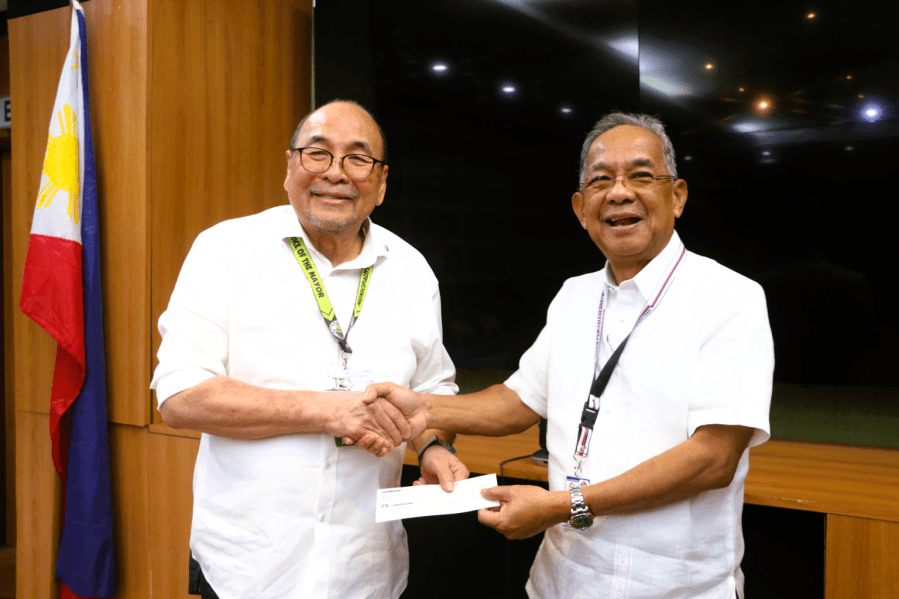

📸 SBMA Chairman Eduardo Jose Aliño hands over a cheque for the LGU share of Subic, Zambales to Mayor Jeffrey Khonghun in this file photo taken in February 2024

Leave a comment